The Ontario Pension Board has appealed after several provincial public servants were allowed to claim a full pension when their work was transferred to the federal government despite continuing to work in their new jobs at the Canada Revenue Agency.

The employees worked at Ontario’s former revenue ministry in the administration of the province’s Retail Sales Tax Act but moved to the federal department as of March 2012 after the implementation of the Harmonized Sales Tax.

Under the Public Service of Ontario Act, the employees had to be members of the public service pension plan. They argued they should be able to claim their pensions because they were no longer Ontario public servants when they made the move to the federal department.

In a May 7 decision, the Financial Services Tribunal sided with the workers after the superintendent of financial services indicated it would refuse their request to start receiving benefits.

“Those applicants who are eligible for an unreduced pension under the plan as of March 1, 2012, have the right to start receiving that pension, notwithstanding that they may continue to be employees of the CRA,” wrote the three-member tribunal panel.

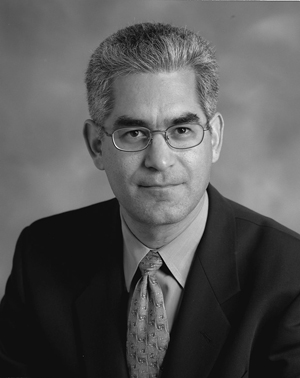

Murray Gold, managing partner at Koskie Minsky LLP, represented the pension board at the tribunal and says his clients have appealed to the Divisional Court.

“We were surprised,” says Gold. “There were two prior decisions by the tribunal on the issue that supported our case.”

He says the five applicants who won the case have used the transfer to gain an unfair advantage over other plan members.

“People ought not to decide that their employment has been terminated and that they can retire while continuing to work with the new divested employer,” he says. “There are limited exceptions, but generally the rule is you work, then you stop work, and draw a pension.”

Kristen Rose, a spokeswoman for the Financial Services Commission of Ontario, said the superintendent supports the board’s appeal.

“The decision of the Financial Services Tribunal was a departure from previous Financial Services Tribunal decisions on the same issue,” Rose said in a statement.

“Our position is that the employment of the applicants is deemed not to be terminated for the purposes of the Pension Benefits Act.

Consequently, they are not entitled to begin receiving pension benefits.”

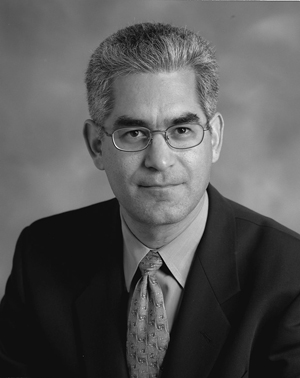

One of the applicants, Mehdi Ratansi, a former senior manager at the ministry, presented the case at the tribunal on behalf of himself and 27 colleagues. Ratansi was one of six who had qualified for an unreduced pension on the date of the transfer to the federal department (he opted not to accept the job offer but instead started his own business as a tax consultant).

The decision directly affected five applicants who qualified for full pensions and accepted offers from the federal department. The tribunal said a further hearing would be necessary to deal with the remaining 22 applicants.

Ratansi didn’t want to comment on the case and says he and his fellow applicants have yet to decide whether to appoint a lawyer for the appeal since more stringent rules at the Divisional Court prevent him from appearing for anyone but himself.

The case revolved around s. 80 of the Pension Benefits Act. It deals with the sale or assignment of an employer’s business to a new entity. The case also involved a subsection that states that any employees transferred under it are deemed to not have been terminated as a result of the transaction for the purposes of the act.

The employees relied on the section of the public service pension plan governing cessation of membership. They argued that while termination may not have occurred for the purposes of the act, they had been terminated for the purposes of the plan.

Subsection 3(c) of the pension plan allows members to withdraw voluntarily in writing “where that member is not required to be a member of the plan.” Since they were no longer Ontario public servants, they argued, they didn’t have to be members of the plan and could withdraw.

The pension board’s case centred on the act rather than on the plan. It argued that previous tribunal decisions had established s. 80(3) as a statutory bar because all of the employees’ options for receiving pensions relied on the termination of their employment.

But the tribunal ruled its previous decisions “did not consider the possibility that a deemed continuance of employment for purposes of the act might not govern the rights of the employees under their respective plans” and said it must determine the rights of members in a “more contextual manner.”

“We must deal with the plan language as we find it,” the panel wrote.

“If the applicants are no longer mandatory members — and they clearly are not — they are entitled to elect to cease their membership even if their employment status is deemed to continue. We would be persuaded otherwise only if it were necessary to give effect to the statutory purposes of the [Pension Benefits Act]. We have determined that no statutory purpose is frustrated by allowing the applicants to withdraw from the plan.”