A Toronto personal injury lawyer is facing a class action spearheaded by a former client who won $150,000 as a settlement award but alleges she ended up keeping only $8,000 of it.

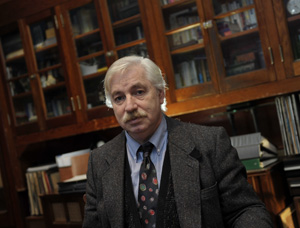

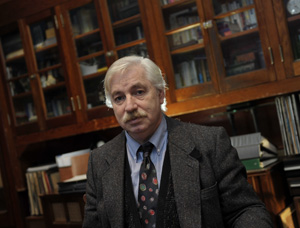

Cassie Hodge of Brooklin, Ont., is taking Gary Neinstein and his firm, Neinstein & Associates LLP, to court with a claim that the lawyer unlawfully included costs in a contingency agreement and charged her fees she didn’t understand. She’s seeking $1 million in punitive damages. None of the allegations have been proven in court and Neinstein has yet to file a statement of defence. His lawyer, however, argues the matter is an inappropriate one for a class action.

According to her notice of application, Hodge, a mother of two, was in a car accident in 2002 that left her with serious physical injuries. She retained Neinstein as a lawyer and signed an agreement that said she’d pay him 25 per cent of the damages recovered in addition to partial indemnity costs and disbursements.

But she didn’t receive a copy of the agreement, her counsel Peter Waldmann says.

Nearly three years ago, Hodge won a $150,000 settlement award that included costs. Neinstein told Hodge that $100,000 of the amount was for the claim and the rest would go to “party and party costs” and disbursements, according to Hodge’s pleading.

“I received no explanations as to how the breakdown of $150,000 into $100,000 for the claim and $50,000 was arrived at,” she wrote in her affidavit.

“I was not consulted about it and the minutes of settlement is silent on it.”

In the end, Hodge said she paid Neinstein & Associates $60,000 in fees. That amount included “legal fees” and

“party and party costs.” She also paid the firm nearly $50,000 in disbursements, according to the claim. At the same time, she says she paid about $32,000 for a third-party litigation loan after borrowing $19,500 at an interest rate of 26 per cent in addition to other costs.

“The listed disbursements included $4,008.27 in photocopies, $2,791.2 in laser copies, and $1,280.7 for scanned documents, being a total for copies of $8,080.17,” her application states.

The disbursements also included “interest recovery charges,” Waldmann tells

Law Times. It’s unclear what this fee means as lawyers can only charge interest once they’ve rendered a bill, he says.

For the purpose of her lawsuit, Hodge was able to obtain an unsigned copy of the retainer agreement, according to Waldmann.

When Hodge requested backup invoices and receipts for the disbursements Neinstein allegedly claimed, she was asked to pay a $500 retainer in advance to prepare the materials, Waldmann wrote in the notice of application.

The agreement Hodge signed “does not contain a statement that the client and the solicitor have discussed options for retaining the solicitor other than by way of contingency-fee agreement, including retaining the solicitor by way of an hourly rate retainer,” the notice of application states. This is contrary to s. 2(3)(i) of the regulation, Hodge alleges.

Including costs in a contingency-fee agreement without approval of the Superior Court is illegal, Waldmann claims.

“We have a law in force which says that contingency agreements can’t include costs,” he says.

“A lawyer can’t take any part of the costs unless a judge approves it and if you look at s. 28 [of the Solicitors Act], a judge is only to approve it if there are extraordinary circumstances.”

The agreement Hodge signed also doesn’t contain a statement that lets the client know of her right to ask the Superior Court of Justice to review and approve the lawyer’s bill, Waldmann wrote in the notice of application.

Ensuring clients are aware of the meaning of the fees a lawyer asks them to pay is at the heart of the regulation, says Waldmann. “Most people don’t understand the concept of costs. So when they’re signing an agreement, they’re told fees are going to be 25 per cent of whatever the recovery is plus the costs. They don’t necessarily appreciate what the cost part means.”

Although there are no statistics showing how often these situations occur, “if this is a general practice — and it appears to be — there are possibly thousands” of litigants who have unlawfully paid costs to their lawyers, Waldmann charges.

For its part, Neinstein & Associates is preparing its response, says counsel Chris Paliare of Paliare Roland Rosenberg Rothstein LLP. “We’ve told [Waldmann] from the very outset, before the court, that this is a class proceeding without merit.”

The complainants may pursue other remedies for their claims, but they don’t include a class action, says Paliare.

“That’s the position we’ve had since the outset. That’s not to say that [Waldmann’s] client or clients, if they have more, don’t have an alternative remedy.”

Waldmann says two other plaintiffs, also former clients of Neinstein’s, are involved in the case.

There were no provisions for contingency fees prior to 2004, according to Waldmann, who notes they had been considered illegal up until then. But there were a few cases before 2004 that found otherwise and those rulings led to their legalization, he adds.

“When they were legalized, there were provisions put into the Solicitors Act, s. 28, and regulations were passed which concerned being fair to the public. The purpose of the statute is that the client understands and is treated fairly.”

In December, meanwhile, a Superior Court judge awarded $7,000 in costs to Neinstein & Associates after Hodge brought a motion for a third-party funding agreement and abandoned it after the funder withdrew its commitment to finance her litigation.

Cassie Hodge of Brooklin, Ont., is taking Gary Neinstein and his firm, Neinstein & Associates LLP, to court with a claim that the lawyer unlawfully included costs in a contingency agreement and charged her fees she didn’t understand. She’s seeking $1 million in punitive damages. None of the allegations have been proven in court and Neinstein has yet to file a statement of defence. His lawyer, however, argues the matter is an inappropriate one for a class action.

Cassie Hodge of Brooklin, Ont., is taking Gary Neinstein and his firm, Neinstein & Associates LLP, to court with a claim that the lawyer unlawfully included costs in a contingency agreement and charged her fees she didn’t understand. She’s seeking $1 million in punitive damages. None of the allegations have been proven in court and Neinstein has yet to file a statement of defence. His lawyer, however, argues the matter is an inappropriate one for a class action.