Up to 700 Ontario golf courses could be eligible for millions in property tax reductions pending the outcome of a tax appeal test case between the Municipal Property Assessment Corp. and the owners of the storied Glen Abbey club in Oakville, Ont.

The issue dates back 10 years, when Ontario switched to a system of current value assessment in order to have more regular updates of property values for tax purposes.

Jeff Calderwood, executive director of the National Golf Course Owners Association Canada (NGCOA), notes there are roughly 3,000 outstanding appeals of MPAC’s assessments.

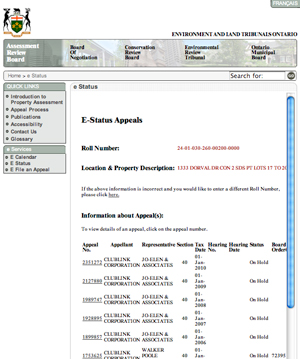

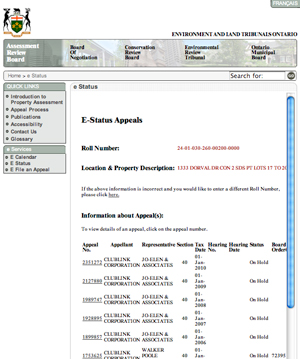

That’s because golf courses typically challenge MPAC’s valuation each time it makes a determination, meaning individual businesses will have multiple cases ongoing. The matters are at various stages, with many of them before the Assessment Review Board (ARB).

“That’s a big issue when you look at an industry as small as ours,” Calderwood tells Law Times.

The issue reached a crescendo last week when MPAC and ClubLink Corp., the owner of Glen Abbey along with several other golf clubs around the province, reached an agreement on the company’s properties.

“We optimistically report that there has been a significant development in the ARB litigation of the Glen Abbey assessment appeal for ClubLink and MPAC,” the NGCOA reported on its web site last week.

“The ARB hearings have been suspended pending a negotiated agreement (MPAC and ClubLink) as to the value of the assessment of Glen Abbey and other Ontario properties. Should there be a fair and equitable final agreement between MPAC and ClubLink, upon analysis the NGCOA Canada will advise its recommendations for outstanding disputes of MPAC’s assessment values.”

Details on the settlement are sketchy, but the issue at the heart of the matter centres on MPAC’s methodology for valuing golf courses for property tax purposes. Paul Campbell, MPAC’s senior valuation manager for industrial and special properties, tells Law Times the historical approach was to assess the land value plus improvements, such as a clubhouse or other facilities.

But years ago, as the new current value regime was coming into play, authorities noticed that, based on sales activity, many properties were undervalued, he notes.

That realization prompted a switch to an income approach, first through what’s called a green-fees multiplier and then through a pro forma valuation based on net operating income. That’s the measure MPAC has used for the last three assessments, according to Campbell.

While the NGCOA has been involved with the matter, Calderwood says various golf courses have been filing their challenges to MPAC’s assessments individually.

The change in valuation methodology resulted in big tax increases for golf clubs, he adds, noting a central issue is how to remove the business enterprise value - meaning the operation’s worth beyond simply the property itself - from the assessment. The idea is to isolate only the property’s value, he points out.

The current value assessment regime aims to determine the amount a property would sell for in an open market through an arm’s-length transaction between willing buyers and sellers. In the ClubLink case, the ARB has adjourned the matter to allow the parties to continue working on the agreement, which could form a template for resolving other files.

“If we can come to some sort of agreement . . . it could be the catalyst to move it forward,” Campbell says.

Some cases have settled over the years, but Campbell says there’s been no standard assessment reduction for the golf course properties involved.

“Each golf course has its own circumstances, and we feel it’s appropriate to reflect that,” he adds, noting companies may have different cost scenarios, such as how they pay for water on their courses, that can affect their operating income.

At the same time, municipalities have a role to play in the outcome of any negotiations. Any assessment reduction would affect their revenues and possibly the tax balance between golf course properties and other land uses, meaning they likely would have something to say about the disposition of the appeals.

Calderwood, however, says he’s optimistic the ClubLink matter will help resolve the issue. “I think we’re very near the end,” he says. “It’s a 10-year, long-standing issue.”

The issue dates back 10 years, when Ontario switched to a system of current value assessment in order to have more regular updates of property values for tax purposes.

The issue dates back 10 years, when Ontario switched to a system of current value assessment in order to have more regular updates of property values for tax purposes.