Service of demand by Quebec Revenue Agency on Calgary branch deemed valid

The Supreme Court of Canada’s June judgment in 1068754 Alberta Ltd. v. Québec (Agence de Revenue) means that tax evaders will have no more luck hiding their assets extra-provincially than they currently do internationally.

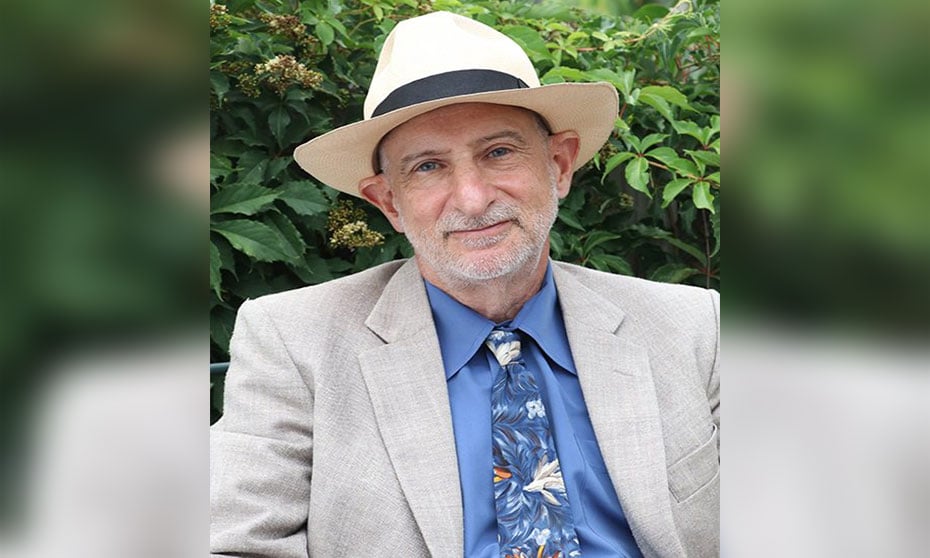

“This was an extraordinary 9-0 decision ensuring tax authorities that they will be able to get information out of any Canadian province just as they do from places like Switzerland,” says David Rotfleisch, a founding lawyer at tax boutique Rotfleisch & Samulovitch P.C. in Toronto.

While the case involved the Quebec Revenue Agency’s demand for production for bank records at a Calgary branch of the National Bank where the Quebec-based taxpayer maintained an account, it is of Canada-wide import.

“The law is now that a tax authority in one province can seek information that resides in another province to the same extent that it can seek that information in its own jurisdiction,” Rotfleisch says.

1068754 Alberta Ltd. was the sole trustee of the DGGMC Bitton Trust, an entity governed by Alberta laws. As part of an audit to determine whether the trust’s management and control resided in Québec, the QRA sent a demand to the Calgary branch of the National Bank requesting bank records and other information relating to the trust.

Alberta Ltd. asked the Quebec Superior Court to quash the demand, arguing that the Calgary branch was distinct from the Bank for the purposes of seizure, including demands for information. To support its argument, the company pointed to the provisions of the Bank Act providing that a “writ” or “process” in a legal proceeding must be served on a specific branch in order to bind property in the bank’s possession — thus distinguishing the bank as a whole as an entity separate from its individual branches.

As the company saw it, a demand for information was analagous to a “writ” or “process”, meaning that it had to be served on the branch in the possession of the information. But because the branch was in Calgary, the company maintained, he provincial tax authority acted outside its constitutional power of taxation within the province by serving the demand outside of Québec.

Both the Superior Court and the Court of Appeal found that the demand was valid, and the SCC agreed.

The high court found that documents such as the demand that were issued by an administrative agency were not akin to writs and processes, documents issued exclusively by the courts. The branch was only distinct from the bank for the purpose of binding the property of a customer. Here, however, the demand did not seek to encumber the property itself, and, in any event, the information sought was the property of the bank, not the customer.

It followed that the QRA had not acted extraterritorially because the National Bank operated and was headquartered in Québec: The Bank Act merely provided a practical means to notify the bank as a corporate entity. The court added that once service was effected on the branch, the bank as a whole was bound.

Finally, the court cautioned that it was not clear whether the QRA would have the authority to issue a similar demand to a corporation with no operations in Québec. A Davies Ward Phillips & Vineberg bulletin also opines that the decision should “not be read as conferring upon the [QRA] the jurisdiction to enforce Québec’s taxation statutes outside its territorial boundaries. . . since [Quebec legislation, unlike the federal Income Tax Act] does not provide for a specific power to require foreign-based information . . .”