Powers of attorney are expected to be more heavily scrutinized in real estate transactions after the Ontario Superior Court ruled that a bank is on the hook for a $300,000 mortgage on a home that was fraudulently sold.

The case also was the first to interpret the crucial

Lawrence v. Maple Trust Company decision of 2007.

“The decision is going to have an enormous impact on how banks, real estate agents, lawyers, buyers - basically all industry stakeholders - treat any transaction involving a power of attorney,” says real estate lawyer Bob Aaron.

“From now on the documents are going to be scrutinized very, very carefully by everybody.”

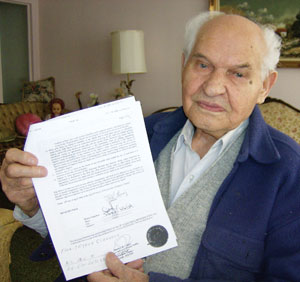

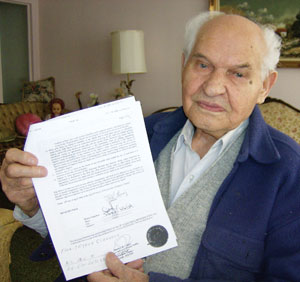

In a December ruling that gained little attention, Justice John Macdonald found that an elderly North York man, Paul Reviczky, is not on the hook for a mortgage that was taken out on his investment property after it was sold using a fraudulent power of attorney.

Reviczky, 90, tells Law Times that after the judgment was released, he “felt much better than before.”

In the case, Reviczky v. Meleknia and HSBC Bank Canada, Macdonald interpreted Lawrence and concluded that the issue in Reviczky was whether HSBC “had an opportunity to avoid the fraud.”

Macdonald concluded that a solicitor obtained by HSBC “did nothing to scrutinize the power of attorney,” which was notarized by North York lawyer Sheldon Caplan and used to sell Reviczky’s property for $450,000, in May 2006, to Pegman Meleknia, who took out a $300,000 mortgage with HSBC.

In his decision, Macdonald referred to Lawrence, which reasserted the principle of deferred indefeasibility of title accords with the Land Titles Act. He quoted the following from that decision: “Under this theory, the party acquiring an interest in land from the party responsible for the fraud (the ‘intermediate owner’) is vulnerable to a claim from the true owner because the intermediate owner had the opportunity to avoid the fraud.

However, any subsequent purchaser or encumbrancer (the ‘deferred owner’) has no such opportunity. Therefore . . . the deferred owner acquires an interest in the property that is good as against all the world.”

HSBC argued that Meleknia was an intermediate owner, and therefore a deferred owner, making the bank’s charge against him indefeasible, based on the Lawrence ruling. However, in interpreting Lawrence, Macdonald found that, “Within the broader notion of transactional proximities to the fraudster is the more specific, determinative factor, the opportunity to avoid the fraud.”

In his concluding remarks in the decision, released on Dec. 19, Macdonald says, “Casting the test of opportunity to avoid the fraud may appear to move it closer to a fault test. However, in Lawrence, allegations that the chargee, Maple Trust Co., failed to exercise due diligence were abandoned . . . The Court of Appeal held that Maple Trust Co. had an opportunity to avoid the fraud even though there was no lack of due diligence on its part. Legal fault concepts were not part of the ratio in Lawrence. Yet, one of the principles on which the decision was based was encouraging lenders to be vigilant when making mortgages.”

He later writes, “The bank had the opportunity to avoid the fraud . . . It dealt with the fraudster and, whether through its solicitor or otherwise, it did not take steps to scrutinize the power of attorney. The bank chose to put itself in proximity to the unknown fraudster in this transaction by dealing with him, yet it failed to make use of the opportunity to avoid the fraud, which that proximity gave it.”

The judge declared the bank’s charge invalid and awarded Reviczky costs against the bank on a partial indemnity basis.

Gavin Tighe, who represented Caplan as an intervener in the case, says Reviczky “has highlighted powers of attorney as a pretty significant document in some real estate transactions.

“Number two, I think it’s a pretty significant case in terms of dealing with the application of the Lawrence decision, from a conveyancing perspective, in whether or not a purchase money mortgage situation is different than a conveyance down the road, in terms of being an immediate owner or intermediate owner or deferred owner or what have you.”

Aaron says he hopes, in light of the ruling and facts surrounding Reviczky, that the standard-form real estate agreements will be amended to consider how powers of attorney will be treated in the future. He also notes that the Ministry of Government and Consumer Services will soon introduce a new requirement for solicitors using a power of attorney to certify its validity.

Aaron, who says the change would require lawyers to sign a “document of law” declaring the power of attorney valid, expects it to take hold by the end of March.

“That’s going to be very difficult for some lawyers,” says Aaron. “If, for example, the power of attorney was signed years ago and the person is mentally incompetent, it may be very difficult for the lawyer to satisfy himself or herself that it’s still valid.”

While the decision may lead to greater speculation of powers of attorney, Aaron agrees with Macdonald’s ruling.

“I think it was a good decision, and I think people are now going to be even more careful about dealing with powers of attorney and identity fraud.”

Reviczky’s lawyer, Tonu Toome, says he’s yet to prepare a bill of costs in the case and notes that the order still must be finalized. He says Reviczky lost about $13,000 in rental fees through the ordeal.

He says his client continues to seek damages and that, “My next target is really the Land Titles Assurance Fund.”

Toome says that, on a personal level, it was satisfying to see a positive outcome for Reviczky, who uses income from the investment property to help relatives in his native Hungary.

“I was happy about this result,” says Toome. “I think Justice Macdonald came up with a well-reasoned decision . . . It just gets rid of another hurdle for my client, and now the hurdle’s not as large as it would have been had the mortgage been found valid.”

The case also was the first to interpret the crucial Lawrence v. Maple Trust Company decision of 2007.

The case also was the first to interpret the crucial Lawrence v. Maple Trust Company decision of 2007.