While the economy continues to founder in the midst of a global recession, large-firm managing partners insist lawyers’ jobs are safe and that they remain focused on improving their long-term business prospects.

“We’re not out hiring all kinds of new people. As a matter of fact, a very rigid business case has to be made before we bring on any new people,” Borden Ladner Gervais LLP national managing partner Sean Weir tells Law Times.

“We’re not out hiring all kinds of new people. As a matter of fact, a very rigid business case has to be made before we bring on any new people,” Borden Ladner Gervais LLP national managing partner Sean Weir tells Law Times.

“And with respect to our existing complement, all we’re doing is that we’re not undertaking any layoffs. What we are doing is our normal monitoring and admissions process, and we just monitor and assess people on performance on an annual basis.”

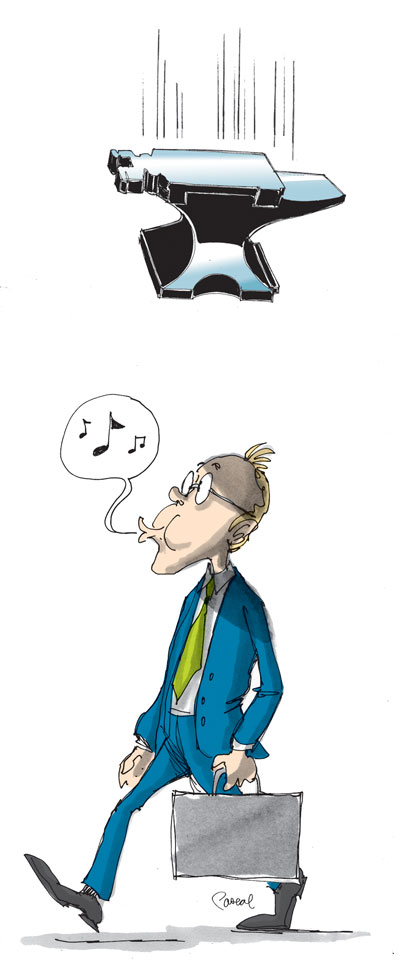

But while managing partners remain generally upbeat and optimistic, the legal rumour mill and online chat sites continue to churn out speculation of looming lawyer layoffs, along with fears that large firms won’t be able to hire back some articling students. Many continue to insist it’s not a matter of if, but when, pink slips are delivered.

Some observers suggest firms have been holding off on making tough decisions on layoffs until April, but many managing partners insist they have no hard timelines for making such moves.

Stephen Bowman, managing partner of Bennett Jones LLP’s Toronto office, says the firm has not instituted any layoffs, and that it remains focused on improving its legal talent.

“For us, it’s business as usual in terms of focusing on developing people, bringing people along in their careers, advancing them, helping them advance, and in fact we’re always looking for talented people who would be a good fit for us,” says Bowman.

Richard Trafford, managing partner of Miller Thomson LLP’s southwestern Ontario offices, says his firm has experienced a surge in litigation work. In fact, he says the firm could use two more lawyers to handle extra business that has recently piled up.

Adam Lepofsky, president of legal recruitment company RainMaker Group, says firms are “holding

steady” at this point.

“Firms will wait until different pockets get busier before they hire anybody, unless there’s a partner with a practice or group with a practice that is coming to the table, hiring will only be on a required basis,” he says. “There is no predictability right now.”

Considering the glut of doom and gloom in business news pages, it would not be a shock to hear that law firms are pondering job cuts.

Bank of Canada governor Mark Carney recently told reporters at a meeting of G20 central bankers and finance ministers that Canada’s recovery from the recession “will be both attenuated and delayed.” He is expected to revise his January prediction that the economy would grow 3.8 per cent next year.

In February, the country’s economy lost 82,600 jobs, and the unemployment rate grew to a five-year high of 7.7 per cent.

But it seems lawyers here are being assured - at least for now - that they will avoid the bloodletting seen in many industries, and in New York and London’s legal markets.

It should be noted, however, that some large firms would not talk to Law Times for this article. Of the 11 firms contacted regarding their hiring/firing outlook, four of- fered comment, three declined to discuss the issue, and four simply didn’t respond.

Weir says BLG is taking a “conservative stance” to managing its complement of legal talent. The firm is fortunate to have a balanced practice, which has enabled it to weather the economic storm, he says. Like other firms, adds Weir, BLG continues to “monitor things very, very carefully. But at this time, things are looking stable, I guess is the best way to put it.”

Weir says BLG was “moderately behind” its fiscal plan for January, but rebounded in February to make up for that loss and put the firm ahead of plan for the first two months of the year. He notes that the plan has “an element of conservatism built into it.”

Weir says, “If that carries on, we will continue with conservatism, but we will not be needing any drastic action.”

Bowman says Bennett Jones has experienced an increase in litigation and insolvency work since the economic downturn took hold, while corporate transactions fuelled by bank financing are down.

“We’re seeing an increasing amount of some stirrings of activity in corporate transactions, either because buyers that have financial capacity are in a position to pick up assets at prices that interest them, or because sellers are in a position where they really have to sell,” says Bowman.

“So we’re seeing somewhat more activity than even, I would say, in the last few months,” he adds. “It’s sort of trending upwards, I would say.”

He suggests the Toronto legal market has avoided the massive layoffs seen in New York and London due to the Canadian economy’s apparent strength compared to those jurisdictions, and because law firms here are better structured to face a downturn.

Canadian firms have “more flexible practices where people can re-deploy themselves from one side of the practice to another,” he says.

Bowman says the firm’s training regime has been shifting toward the restructuring side, but “we’re not taking blocks of lawyers and saying, ‘Now we’re going to retrain you to do something different.’ Instead what we’re doing is just getting people involved in files and they’re learning it by doing it with the senior people who’ve got the expertise.”

Bowman says, “We view it as a very long-term business - practising law. The kind of things you do at any one time comes and goes, but for us it’s a matter of just training, development, building the basic skills, and finding opportunities to serve clients.”

He says the firm has not pinpointed any specific date to make a decision on job cuts.

Trafford says corporate commercial work is “steady” at the Miller Thomson offices he oversees in Guelph, London, and Kitchener-Waterloo. He says the firm has not had to purge any lawyers as a result of the downturn.

“I look at the numbers all the time, and I see us as being as strong as we have been in the years past,” he says.

“Although our corporate guys may not be as busy as they were when they were getting run off their feet, they’re still extremely busy,” says Trafford.

“I don’t believe the downturn will be all that long for us in southwestern Ontario,” he says.

Trafford notes that Waterloo-based BlackBerry maker Research In Motion Ltd. is looking to hire 3,000 new workers.

Michel Brunet, chairman and chief executive officer of Fraser Milner Casgrain LLP, says his firm has not turned to further layoffs since last fall, when it purged two per cent of its approximately 550 lawyers following budget consultations.

Brunet says the firm’s banking and mergers and acquisitions lawyers have shifted their focus to restructuring, which has happened during past recessions.

He notes that there’s a bit of give-and-take for a large firm like FMC, with capital markets work drying up, for example, while infrastructure matters rise as governments try to spur economic recovery.

Brunet says the firm has heeded the advice of a legal industry commentator who urged firms to soldier on with strategic plans despite the recession. He says the recent hiring of a chief client officer demonstrates FMC’s commitment to integration as a national firm.

Practice management specialist Karen Bell says, “We’ve got to get through this first quarter” before any major decisions on layoffs are made.

“The effect on our practice is not as immediate as in some of the other sectors,” she says. “What happens at a particular firm will depend on its practice complement.”

While practising lawyers’ jobs may be safe for now, the next crop of lawyers may be the ones paying the price for the current economic slump.

Canadian Bar Association president Guy Joubert tells Law Times sister publication Canadian Lawyer 4Students, “If law firms are focusing on trying to keep their associates and stabilizing their staff and lawyer complement, they may not necessarily take on as many students to start off with, and they may not necessarily keep on as many students as they have in the past.”