Now that Justices Beverley McLachlin and Marshall Rothstein have left the Supreme Court of Canada, many in the tax bar are wondering not only who will carry the tax torch going forward but if Canada’s top court will have the appetite to tackle complex tax cases.

Now that Justices Beverley McLachlin and Marshall Rothstein have left the Supreme Court of Canada, many in the tax bar are wondering not only who will carry the tax torch going forward but if Canada’s top court will have the appetite to tackle complex tax cases.

It’s an important question, as both the Tax Court of Canada and the Federal Court of Appeal tackle some meaty cases in the area of the General AntiAvoidance Rule and the complex issue of transfer pricing.

Cases touching on those important subject matters could be heading to the top court over the next few years.

Rothstein, who retired in the summer of 2015, had been the perceived torch carrier when it came to tax cases at the SCC.

A former justice on both the Federal Court trial and appeal division prior to joining the SCC in 2006, Rothstein’s fingerprint is on most of the SCC tax rulings made since his appointment. As a Federal Court of Appeal justice, he also heard Tax Court of Canada appeals.

McLachlin also showed an aptitude for the complexity of tax law, an area that often gets overlooked for its importance to commerce and citizens.

For example, in 2005, she and fellow Justice John Major co‑authored the major ruling in Canada Trustco Mortgage Co. v. Canada, which shaped how the General Anti-Avoidance Rule of the Income Tax Act should be applied. That case is considered by some tax professionals to be one of the three top tax rulings made by a court in Canada.

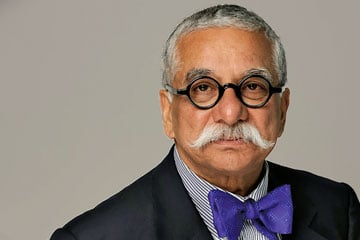

Tax litigator Al Meghji of Osler Hoskin & Harcourt LLP says he hopes the departure of Rothstein and McLachlin “doesn’t mean that the court will be less interested and treat tax with lesser importance than the court has over the past number of years.”

Interestingly, the SCC did not rule on a tax matter in 2017 in any of its 67 cases, according to SCC watcher and appeal lawyer Eugene Meehan of Supreme Advocacy LLP in Ottawa.

Does that mean the court has lost its appetite to hear tax matters? Not necessarily, he says.

“Supreme Court judges see themselves as national judges, not provincial judges on steroids,” he says.

As such, they are selective in which cases they hear and the caseload also depends on what types of appeals are brought to it.

Tax lawyer and law professor Vern Krishna of TaxChambers LLP notes that the SCC traditionally does not give leave to appeal in many tax cases.

“We can consider ourselves lucky if one case or two go up in a year,” he says.

Part of the challenge, he says, is that tax is not perceived as a sexy issue, unlike Charter challenges. Tax cases also tend to get overlooked, he says, when considering what’s of national importance, part of the leave test.

The result, he says, is that “there is comparatively little tax jurisprudence that emanates” from the SCC, unlike the U.S., where its top court is active in tax rulings. Former SCC Justice Frank Iacobucci, a tax lawyer and professor, was “by far the strongest tax lawyer on the SCC,” says Krishna. He was later known for his public law rulings while on the bench.

Krishna says justices tend to grow into a role on the court.

Take former chief justice of the SCC, Brian Dickson.

Dickson was a business and commercial lawyer who became a Charter expert, as the court worked through the implementation of the repatriation of the Constitution and the introduction of the Charter.

Krishna notes that former SCC justice Gerard LaForest did his doctoral thesis in tax at Yale University and wrote some interesting tax rulings, but he was known more for his Constitutional cases. Meehan says Rothstein was a transportation lawyer in private practice before being appointed a judge and wrote more than 1,400 rulings involving that field. It begs the question who will pick up the tax mantle among the current bench?

Recent SCC appointments reflect more of a social justice and public law background. Sheila Martin’s focus was on indigenous, education and equality rights. Malcolm Rowe, a former deputy minister, has a public and constitutional law background.

Russell Brown has focused on negligence and tort, but he has expertise in commercial law and estates. Suzanne Côté has a Big Law pedigree, practising as a commercial litigator at both Stikeman Elliott LLP and Osler Hoskin & Harcourt LLP before being appointed in 2014.Clément Gascon is a former Heenan Blaikie civil, commercial and labour litigator.

Andromache Karakatsanis practised civil, criminal and family litigation before joining the Ontario public service, where she held a number of roles, including deputy attorney general and secretary of cabinet.

Michael Moldaver was a criminal lawyer, while Rosalie Abella practised civil and criminal litigation. Chief Justice Richard Wagner focused on professional liability and commercial litigation. So who is likely to champion tax?

“This is a pretty strong court generally and it’s hard to predict who will assume leadership in this area of law,” says Meghji.

“But my judgment is that the lawyers on the court who have the deepest interest in private law are probably Justices Suzanne Côté and Russell Brown.”